This Information Memorandum is issued by One Adams St Capital Pty Ltd (ACN

666 812 102), trading under the name One Adams St

(“Company”). The Company has appointed Lion Property Group

Pty Ltd (ACN 625 889 367) (“Lion”, “we”,

“us”, “our”) as the Project Manager of the

Company and to assist with marketing efforts.

This Information Memorandum relates to the offer of shares in the Company.

Interests in the Company will be issued as shares in the Company.

The Company, at the date of this Information Memorandum, is not, nor is it

required to be, registered as a managed investment scheme pursuant to

section 601ED of the Corporations Act. This Information Memorandum is not a

product disclosure statement for the purposes of Part 7.9 of the

Corporations Act.

Interests in the Company will be issued only on receipt of a validly

completed Investment Agreement and the receipt of cleared funds. The offer

or invitation to subscribe for interests in the Company is subject to the

terms and conditions described in this Information Memorandum.

The offer contained in this Information Memorandum is intended for

Sophisticated Investors as defined within the Corporations Act. Investments

from non-Sophisticated Investors may be accepted by the Company if the

investment would comply with relevant legislation.

The distribution of this Information Memorandum and the offering of interests

in the Company may be restricted in certain jurisdictions. No recipient of

this Information Memorandum in any jurisdiction may treat it as constituting

an invitation or offer to them to apply for interests in the Company unless,

in the relevant jurisdiction, such an invitation or offer could lawfully be

made to that recipient in compliance with applicable law.

Prospective applicants should inform themselves as to the legal requirements

and consequences of applying for, holding, transferring, and disposing of

shares and any applicable exchange control regulations and taxes in the

countries of their respective citizenship, residence, domicile, or place of

business. It is the responsibility of a prospective investor outside

Australia to obtain any necessary approvals in respect of applying for, or

being issued with, shares.

Unless otherwise agreed with the Company, any person applying for shares will

by virtue of the person’s application be deemed to represent that they are

not in a jurisdiction which does not permit the making of an offer or

invitation as detailed in this Information Memorandum, and are not acting

for the account or benefit of a person within such jurisdiction.

The Company and the Project Manager do not bear any liability or

responsibility to determine whether a person is able to apply for shares

pursuant to this Information Memorandum.

This Information Memorandum does not purport to contain all the information

that a prospective investor may require in evaluating a possible investment

in the Company.

The Company reserves the right to evaluate any applications and to reject any

or all applications submitted, without giving reasons for rejection. The

Company and the Project Manager are not liable to compensate the recipient

of this Information Memorandum for any costs or expenses incurred in

reviewing, investigating, or analysing any information in relation to the

Company, in submitting an application or otherwise.

No cooling off applies to the issue of shares.

Prospective investors should review the Investment Agreement for further

information regarding the rights and obligations of investors of the

Company. To the extent there are any inconsistencies between the Investment

Agreement and this Information Memorandum, the Investment Agreement will

prevail.

In providing this Information Memorandum, the Company has not taken into

account the recipient’s objectives, financial situation or needs and

accordingly the information contained in this Information Memorandum does

not constitute personal advice for the purposes of section 766B(3)

(“personal advice”) of the Corporations Act. None of the Company, the

Project Manager, or their related parties, officers, employees, consultants,

advisers, or agents warrant that an investment in the Company is a suitable

investment for the recipient.

None of the Company, the Project Manager, or their related parties, officers,

employees, consultants, advisers, or agents have carried out an independent

audit or independently verified any of the information contained in this

Information Memorandum, nor do they give any warranty as to the accuracy,

reliability, currency, or completeness of the information or assumptions

contained in this Information Memorandum, nor do any of them, to the maximum

extent permitted by law, accept any liability whatsoever however caused to

any person relating in any way to reliance on information contained in this

Information Memorandum or any other communication or the issue of shares.

The Company strongly recommends that potential investors read this

Information Memorandum in its entirety and seek independent professional

advice as to the financial, taxation, and other implications of investing in

the Company and the information contained in this Information Memorandum. In

particular, it is important that potential investors consider the risks

outlined in this Information Memorandum that could affect the performance of

an investment.

None of the Company, the Project Manager, or their related parties, officers,

employees, consultants, advisers, or agents guarantee the repayment of

capital invested in the Company, the payment of income from the Company or

the performance of the Company or an investment in the Company generally. As

with any investment there are inherent risks in investing in the Company,

including the risk that an investment in the Company is speculative, that

the investment may result in a reduction in, or total loss of, the capital

value of the investment, loss of income, and returns that are less than

expected, or delays in repayment of capital.

The contents of this Information Memorandum are:

- not intended to be disclosed to any person other than the person to whom

this Information Memorandum has been provided to by the Company;

- strictly confidential; and

- not to be reproduced, either in whole or in any part or parts, without

the Company’s prior written consent and, if such written consent is

given, only in accordance with that consent.

The Company has not authorised any person to give any information or make any

representations in connection with the Company which are not in this

Information Memorandum and if given or made, such information or

representations must not be relied upon as having been authorised by the

Company. Any other parties distributing this product to investors are not

the Company’s agent or representative and are doing so on their own behalf.

The Company and the Project Manager are not responsible for any advice or

information given, or not given, to potential investors by any party

distributing this product and, to the maximum extent permitted by law,

accept no liability whatsoever for any loss or damage arising from potential

investors relying on any information that is not in this Information

Memorandum when investing.

The primary language of this document is English. This document may be

translated into different languages. Any translations provided are for

reference purposes only. If there is any inconsistency or conflict between

the English version of this Information Memorandum and versions of this

Information Memorandum in any other language, the English version prevails.

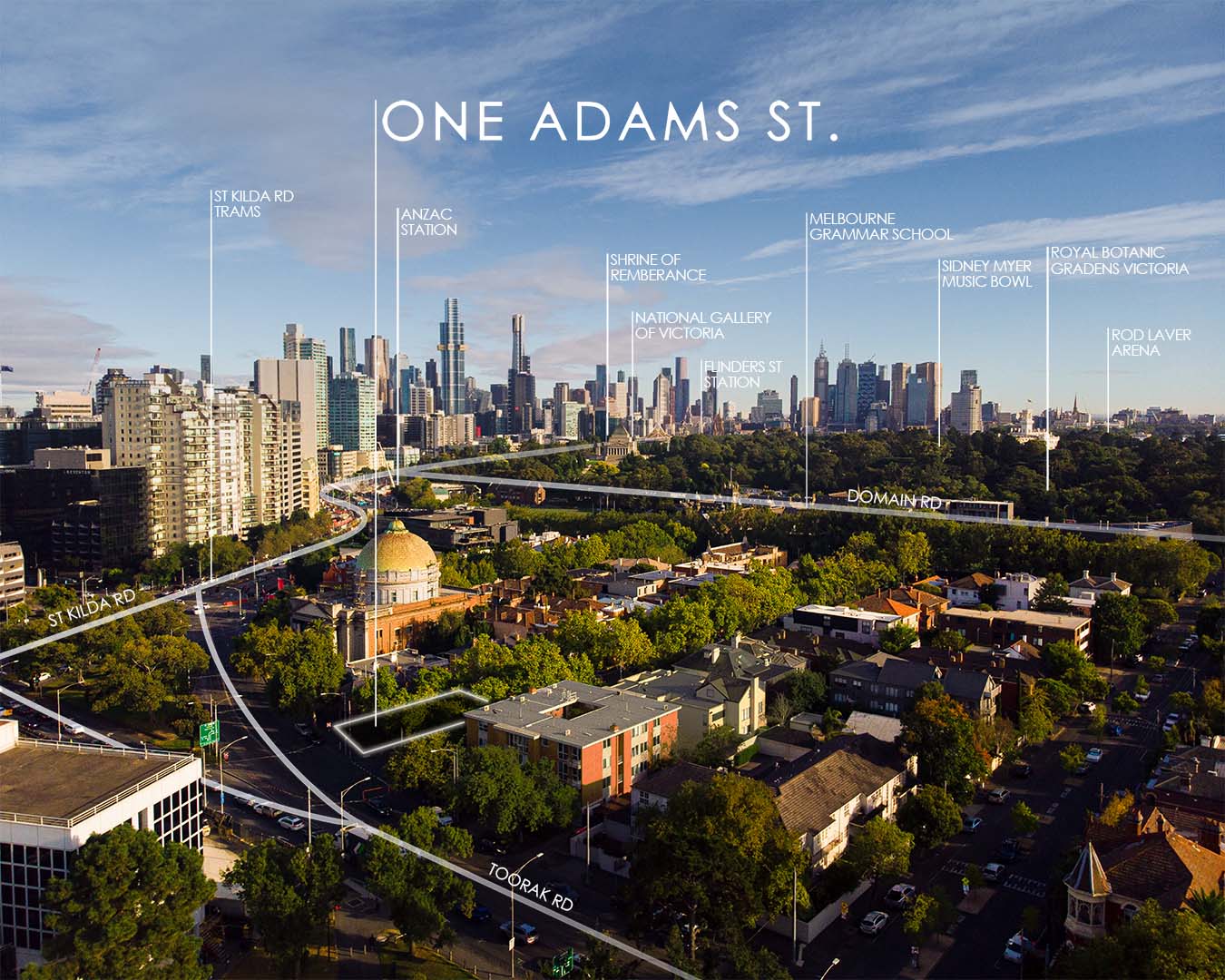

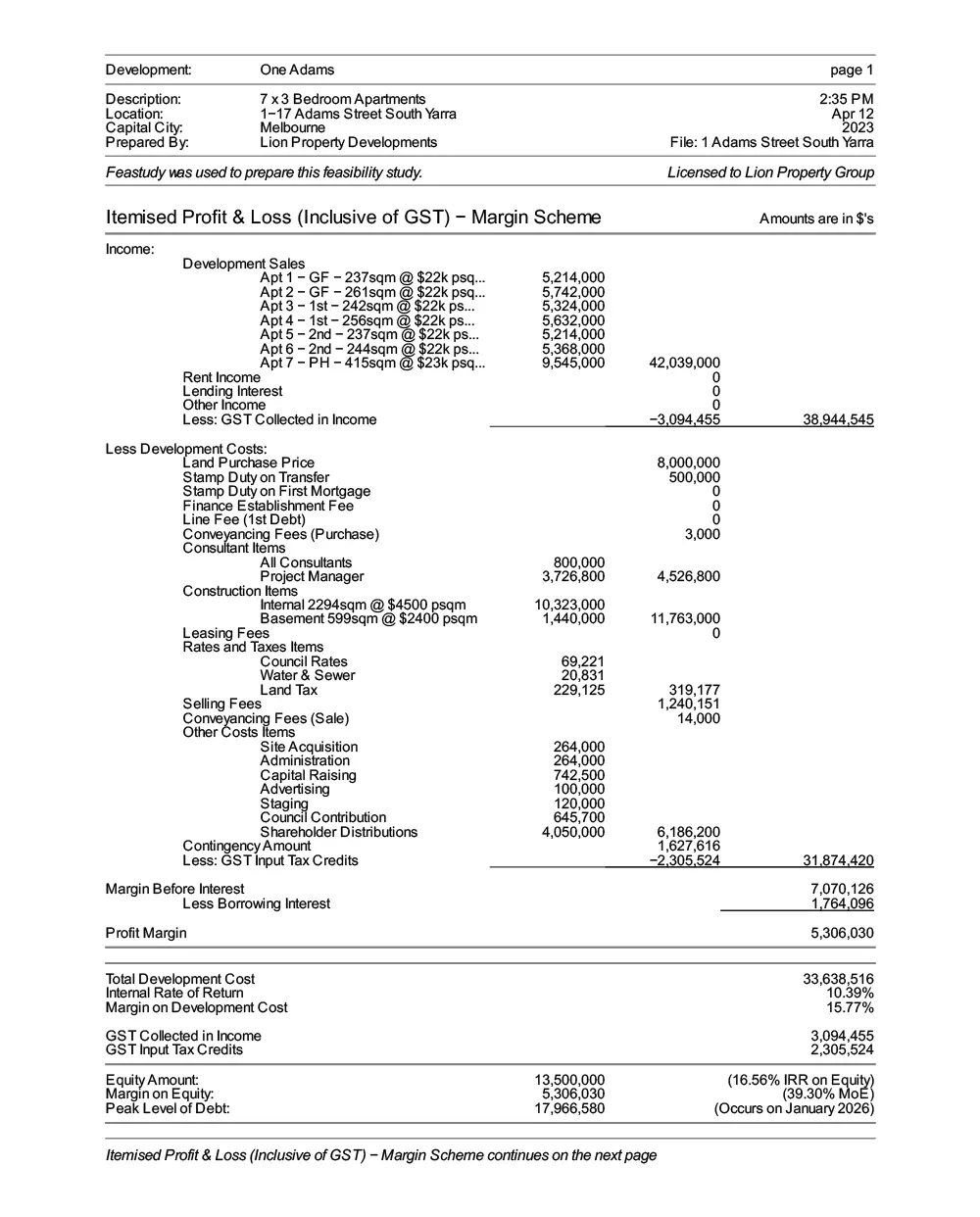

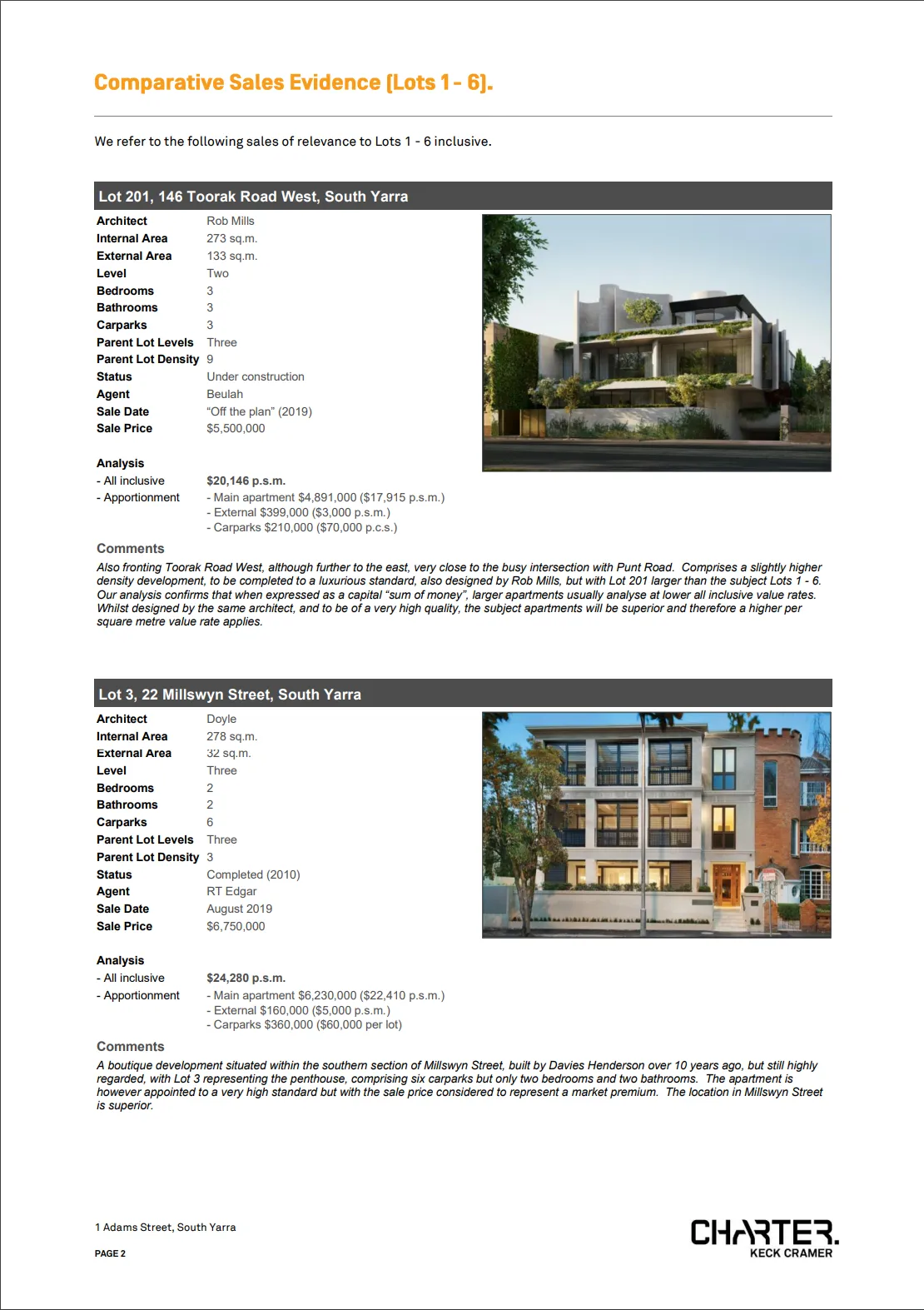

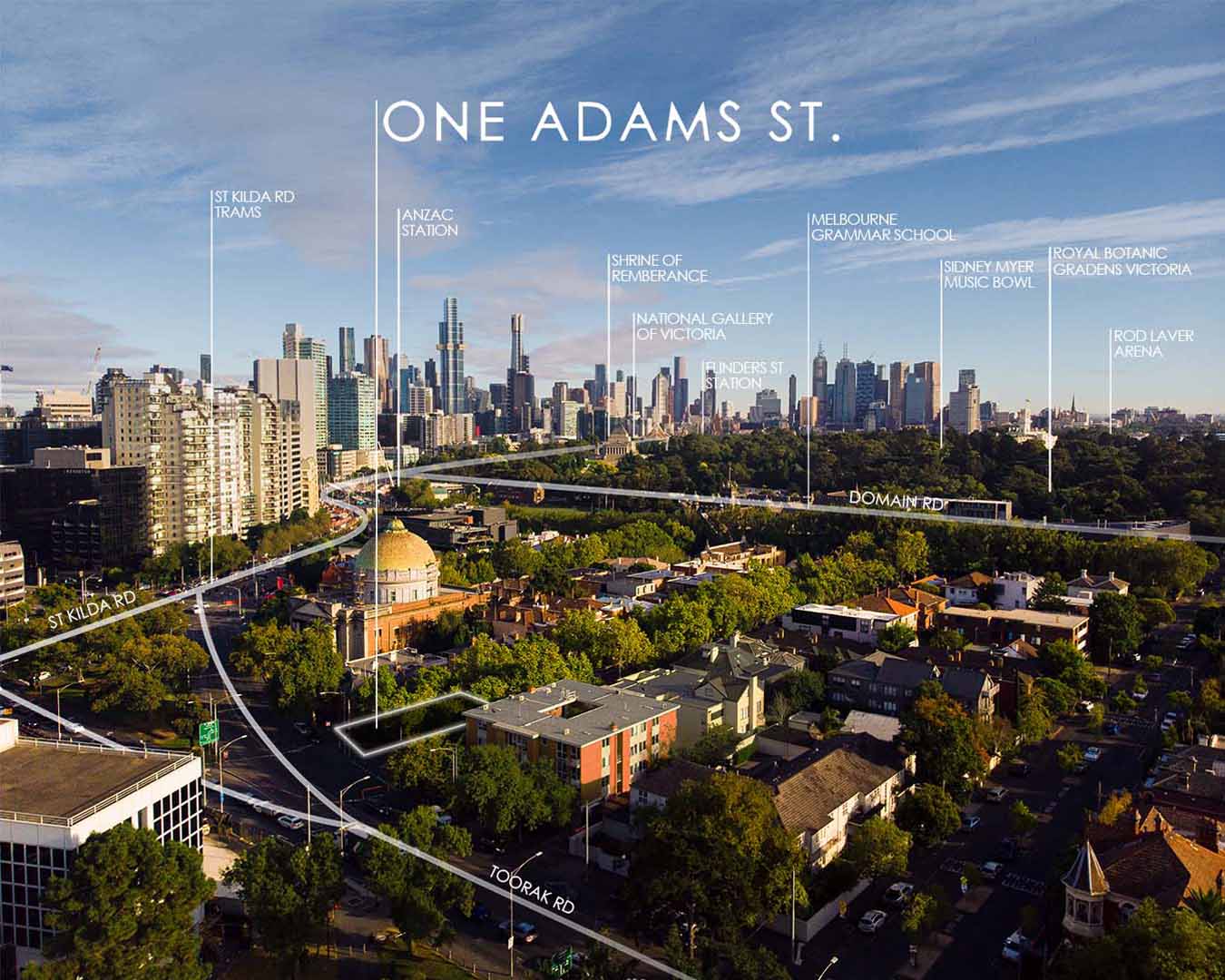

Images, plans, and artistic representations included in this Information

Memorandum are illustrative only and are subject to change.

All references to dollar amounts are references to Australian Dollars, unless

otherwise specified.

This Information Memorandum may, from time to time, be updated. A new

Information Memorandum will be issued to investors if the changes are

materially adverse. An updated version of the Information Memorandum is

available upon request during normal business hours.

This Information Memorandum was initially published on the 16th of April

2023.